The U.S. Department of Education finalized a new set of higher education rules that are aimed at protecting student borrowers.

After being deliberated on for almost two years, the Institutional Accountability regulations posted last week on the Department’s website will hold higher education institutions accountable for misrepresentation and fraud, and providing financial protections to taxpayers by at-risk institutions.

The new rules allow the student borrowers to claim repayment against institutions whether the loan is in default or in collection proceedings. Affected students can file a defense to repayment claims three years from either the student’s date of graduation or withdrawal from the institution. The overall practice would save the taxpayers $11.1 billion over the 2020-2029 loan cohorts,

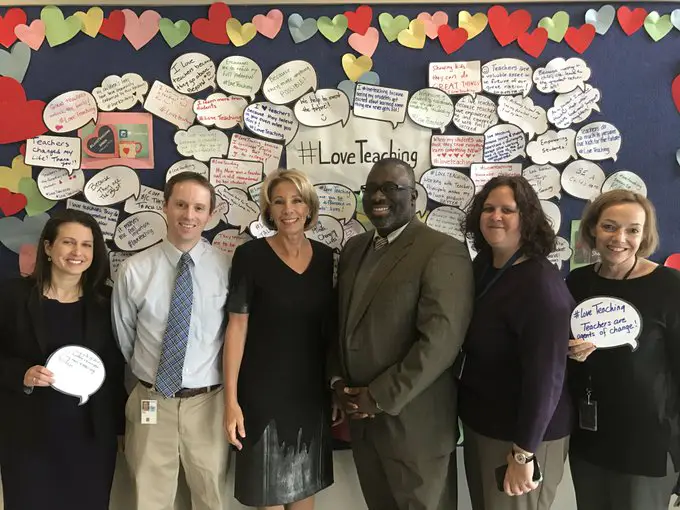

“If a school defrauds students, it must be held accountable,” said U.S. Secretary of Education Betsy DeVos.

“From the recent college admissions scandal and intentional misrepresentations by schools to boost their U.S. News & World Report rankings to fraudulent marketing practices from proprietary intuitions, too many institutions of higher education are falling short. The new regulations are aimed at preventing this behavior because students deserve better, and all institutions must do better,” she added.

Effective from July 1, students will be allowed either to choose an institution’s offer of a teach-out opportunity or submitting a closed school discharge to the Department. Also, the closed school discharge window has been increased 120 days to 180 days.

The rules were subjected to serve criticism from various quarters when they were proposed last year.

Voicing their concerns, the groups feared that it would constitute a reversal from the strong protections issued under the Obama administration in the wake of scandals at for-profit schools like Corinthian College and ITT Tech. They also believe that it would make it practically impossible for students who have been defrauded by higher education programs to cancel their debts.

“The rule eliminates the possibility for group claims, so each individual borrower will have to come forward with evidence, a tactic meant to stop people fighting back as one,” American Federation of Teachers President Randi Weingarten said in a statement on Friday.

“And it imposes a new three-year time limit on claims. It’s why we argued that the entire rule should be scrapped and replaced with something—anything—that strengthens rather than guts protections.”

The Education Department is currently battling a class-action lawsuit filed by nearly 160,000 former for-profit college students for not processing the claims of loan forgiveness under the Obama-era Borrower Defense Regulations, aimed at providing relief to debt-ridden students defrauded by higher education programs. The plaintiffs have accused the department of “intentionally” ignoring students’ claims, not taking action to resolve them, and forcibly collecting loans that may not be valid.

Online, For-Profit Colleges Fail Minority, Low Income Students [Report]