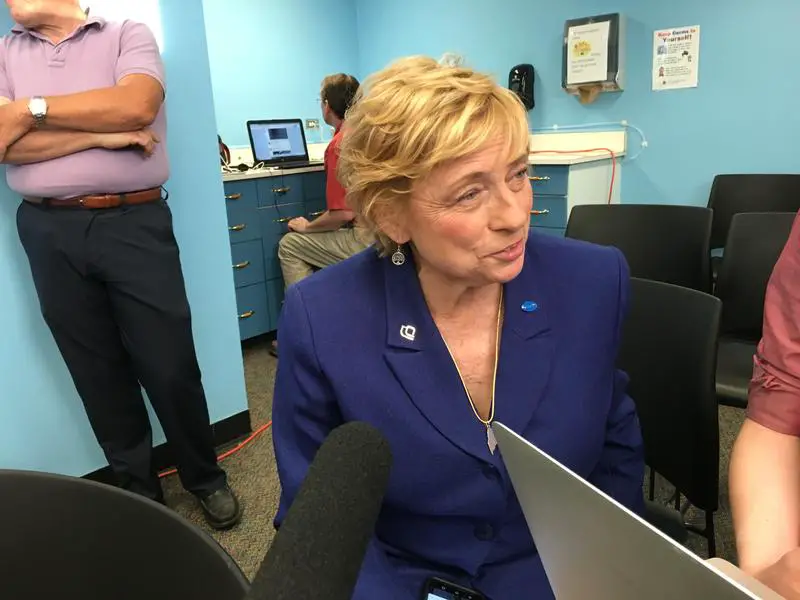

Student borrowers in the state of Maine will soon have stronger protections from loan service providers after Governor Janet Mills signed a bill to protect students from predatory lending.

Mills signed the LD 995, “An Act To Establish a Student Loan Bill of Rights To License and Regulate Student Loan Servicers,” on Thursday. The bill requires student loan lenders who do business in Maine to register themselves, and authorizes state officials to investigate lenders who commit prohibited acts.

It further requires loan lenders to comply with federal law and identifies prohibited acts for lenders, including misleading student loan borrowers and fraud.

“Paying back student loan debt is difficult enough without a profit-hungry lender trying to make it harder and more expensive,” Governor Mills said in a statement. “By signing this bill into law, Maine is taking critical action to create oversight, implement accountability, and protect the interests of our borrowers.”

The bill was sponsored by Senator Eloise Vitelli of Arrowsic who has long been vocal against the companies that service student loans. She also supports loan forgiveness for graduates engaged in STEM careers and those who will stay and work in Maine.

“Far too often, we hear horror stories of student loan servicers taking advantage of borrowers who are only trying to responsibly pay down their debt,” Vitelli said. “I’m grateful for the support this bill has received. I’m sure it will make a real difference in the lives of many Mainers.”

Last month, the California Assembly passed a bill that offers student loan borrowers the same comprehensive protections that consumers with mortgages and credit cards enjoy.

U.S. Senator Amy Klobuchar (D-MN) released a detailed plan last week promising to restore and strengthen rules that allow students who believe they were defrauded by their colleges to apply for loan forgiveness.

Student Loan Debt Puts Borrowers of Color at Disadvantage [Report]