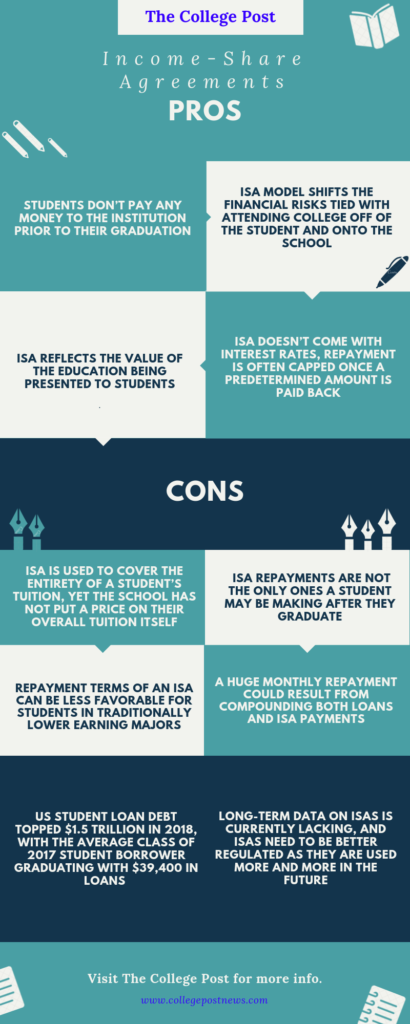

As U.S. student loan debt topped $1.5 trillion in 2018, with the average Class of 2017 student borrower graduating with $39,400 in loans, many students today are seeking new ways to finance their educations.

In response to these requests for alternatives to traditional student loans, a new type of financing option is slowly popping up at colleges and universities across the country: Income Share Agreements (ISA).

Here’s how they work: Instead of traditional loan models where schools charge students for tuition and students pay a set amount back each month with interest after they graduate, under ISAs, students commit to repaying a percentage of their income for a fixed period of time post-graduation in exchange for colleges funding all or part of their tuition costs upfront.

While income share agreements may not be able to compete with federal student loans since most ISA funding currently comes from private investors, ISA providers today are advertising their products as competing with private student loans or Parent PLUS loans whose lending conditions are often accompanied by extremely high interest rates.

The concept has recently peaked the attention of students, families, educators and Silicon Valley investors alike, especially following a New York Times profile of the Lambda School, a for-profit online learning startup which trains future software engineers and uses an ISA financing model.

In the article, author Andrew Ross Sorkin speaks favorably about ISAs, claiming that “it is an approach to treat students as investments rather than cash cows- a fundamental shift that could finally lift the crippling debt load we routinely push onto students.”

However, many readers and researchers of student loan debt quickly took to the internet, criticizing Sorkin’s presentation of ISAs as simply a redefinition of longstanding income taxes and declaring them the next upcoming form of “indentured servitude.”

Silicon Valley is backing a novel idea: Instead of charging students tuition, students go to school for free and are required to pay back a percentage of their income after graduation, but only if they get a job with a good salary https://t.co/nMyIeg2dag

— The New York Times (@nytimes) January 8, 2019

So before U.S. students and their families start blindly jumping in and embracing this new form of college financing, we went to schools and financial experts to look into what the pros and cons of this new financial model truly are. Here’s what we came up with.

The Potential Upsides to Income Share Agreements

When Lambda began operating in 2017, it modeled the thousands of other schools across the U.S. that charge their students for tuition upon enrollment. However, after familiarizing itself with the needs of its attendees, the financial model for its second student cohort changed dramatically, Austin Allred, co-founder and CEO of Lambda School, told The College Post.

“We started out charging upfront like every other school, and as we got to know the students better and understand what their needs were and what they really wanted, we learned that the risk terrified them and that there were a lot of students that would love to join but it’s just too risky,” Allred said.

Now, due to the help of the millions of dollars in external funding that the school receives from venture capitalists, Lambda students don’t pay any money to the institution prior to their graduation.

In accordance with the terms of its ISA, which lasts for five years total after a student graduates, students are required to pay 17 percent of their salary back to Lambda for two years if they get a job in their field that pays more than $50,000.

If they don’t get a job in their field within five years or they make less than $50,000 per year, they aren’t required to pay anything back. Additionally, for all students, total ISA repayments are capped and considered finished once a student has returned $30,000 total to Lambda.

In Allred’s opinion, one of the key benefits of using an ISA model is that it shifts the financial risks tied with attending college off of the student and onto the school.

“A student doesn’t have to worry about ‘If I don’t get a job then my payments are going to be due and I have a seven percent interest rate tacked on to that,’” Allred said. “So it’s really ‘I can go to school. I can focus on school and I don’t have to worry about what happens if this doesn’t work out.’”

Purdue University also offers income share agreements to its students, but under a slightly different model. As opposed to Lambda School where the entire cost of tuition is covered by an ISA, Purdue’s “Back a Boiler” program offers ISAs on top of other loans and grants to cover any unmet financial need that students might have.

Since the “Back a Boiler” program started in the fall of 2016, approximately 800 student contracts have been taken out, amounting to $9.7 million in total funding, Mary Claire Cartwright, the vice president of information technology and the “Back a Boiler” program manager, told The College Post.

Furthermore, out of the 200 undergraduate majors that Purdue offers, 120 have been funded so far by “Back a Boiler” that are accompanied by differing repayment percentages, highlighting how the university does not discriminate in its ISA allocation based on academic major.

Given that the program is still fairly new, Cartwright said transparency about ISAs is a top priority for the school. Along these lines, Purdue offers a comparison tool for students considering participating in the “Back a Boiler” program which allows them to see how an ISA might compete with other types of loans, and requires students applying for an ISA to take a “financial fitness quiz” to ensure that they understand how it works.

Given that the program is still fairly new, Cartwright said transparency about ISAs is a top priority for the school. Along these lines, Purdue offers a comparison tool for students considering participating in the “Back a Boiler” program which allows them to see how an ISA might compete with other types of loans, and requires students applying for an ISA to take a “financial fitness quiz” to ensure that they understand how it works.

Along with other benefits to students such as the fact that income share agreements don’t come with interest rates like traditional student loans and that repayment on them is often capped once a predetermined amount is paid back, many believe that ISAs also incentivize schools to provide the best educational experiences that they possibly can.

According to Charles Trafton, the lead portfolio manager at FlowPoint Capital Partners LP- a company that helps schools and service providers create and invest in income share agreements- because schools that offer ISAs are invested alongside their students, they are often more motivated to ensure student success.

“When a school has built-in financial incentives for not only its students to graduate, and not only to get a job but to get a good paying job, it’s a win because it really aligns the interest with the students when the schools are invested in the ISA, as well as third party investors like us,” Trafton told The College Post.

Another belief surrounding income share agreements is that they reflect the value of the education being presented to students. In other words, if a school knows that they have low graduation rates, low employment rates and low student loan repayment rates among their graduating classes, they are less likely to invest in ISA programs because the chances of their investments panning out are low.

“If an institution wasn’t confident in their programs and their degrees or certificates, then they probably wouldn’t be motivated to offer something like an income share agreement,” Cartwright said.

The Potential Downsides to Income Share Agreements

Following the publication of Sorkin’s New York Times story, Julie Margetta Morgan, a fellow at the Roosevelt Institute and a past policy advisor in the realm of student loan servicing reform to Senator Elizabeth Warren, came out with a piece of her own about why discussions about ISAs may seem too good to be true.

Her answer: They are largely understood and often shrouded in downplayed technicalities. Let’s break this down a little more.

In Margetta Morgan’s opinion, one of the major red flags about income share agreements is when they are used to cover the entirety of a student’s tuition, yet the school has not put a price on their overall tuition itself. This is currently the case at Lambda School.

In this scenario, because the school isn’t directly telling its students what a degree from their institution is literally worth, students may end up paying more than than the tuition is actually valued at.

“I think it’s just a little bit trickier to understand exactly what it is that they’ve given you for that percentage, because there’s not a dollar value assigned to it,” she told The College Post. “And so I think that’s one of the biggest questions, is does the family feel like the proportion of income over the term of years is worth what they’ve gotten for it?”

Another major piece that Margetta Morgan believes students and families should consider before taking out an income share agreement is how, in many cases, those ISA repayments are not the only ones a student may be making after they graduate.

“Particularly when we’re talking about a model like the Purdue one where you may be taking on federal student loans and then an income share agreement stacked on top of it, you would want a family to look at their total obligation,” she said.

Therefore, given the huge monthly repayment that could result from compounding both loans and ISA payments, this is something that borrowers should be aware of.

The specific terms of an income share agreement and the general parameters of the relationship between the funder and the borrower are a third area in which Margetta Morgan urged students and families to exercise caution.

“There’s some measures that we in the world of student loan policy would consider to be somewhat unnecessarily punitive or draconian that we see reflected in income share agreements as well,” she said. “For example, the ability to garnish state tax refunds or to make a large amount of money due upfront if a person fails to either make a payment or provide some other required documentation for their income share agreement.

Terms which involve pushing students into binding arbitration and asking them to waive their rights to participate in class action lawsuits have been documented as well.

Although many income share agreements have been marketed towards people who struggle financially, particularly because they claim that if a student doesn’t make a certain amount of money they aren’t required to pay it back, Margetta Morgan said this aspect of ISAs is often much more complicated that it’s laid out to be.

Especially at schools like Purdue, where the repayment terms of an ISA can be less favorable for students in traditionally lower-earning majors, these types of fine print should be kept in mind.

“In many cases, if you don’t make the amount of money that would trigger payments under the income share agreement, the terms of the ISA would dictate that your repayment terms actually gets lengthened,” she said. “You might not have to pay in that month or in that year, but in many circumstances, you will still have to pay at some point.”

What the Future of Income Share Agreements Looks Like

Despite their differing stances on income share agreements in general, Trafton and Margetta Morgan agreed on two points: Long-term data on ISAs is currently lacking, and ISAs need to be better regulated as they are used more and more in the future.

In 2017, Representative Luke Messer (R-IN) and Senator Marco Rubio (R-FL) introduced the Investing in Student Achievement Act and the Investing in Student Success Act onto the House and Senate floors, respectively. Both pieces of legislation attempt to provide the legal framework that is necessary for private ISA funders to operate, and to better regulate ISAs in general.

While some, such as Margetta Morgan, believe that these pieces of legislation favor ISA investors and could replicate predatory lending practices, both bills have gained some bipartisan support for the time being, representing political interest on both sides of the aisle in higher education finance reform.

Colorado College to Roll Out Income-Share Agreements for DREAMers